Calculate my heloc payment

Use our free mortgage calculator to estimate your monthly mortgage payments. Enter the amount you plan on withdrawing during the draw period.

Mortgage Payoff Calculator With Line Of Credit

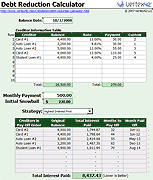

By consolidating your debt with a HELOC you can make one monthly payment with a lower interest rate allowing you to both pay less each month and to pay off your debt more quickly.

. The loan program you choose can affect the interest rate and total monthly payment amount. Age of the loan. The HELOC repayment is structured in two phases.

The VA loan calculator provides 30-year fixed 15-year fixed and 5-year ARM loan programs. Prime Rates are set by the lenders and can differ from institution to insitution. This means unlike the fixed payments in a fixed-rate mortgage a HELOCs rate is variable.

All home equity calculators. Borrowers with a lower credit score may see higher auto interest rates. Making the minimum payment on your credit cards can take you years to pay off your debts.

To decide if you should lease or buy your next vehicle you should consider three main factors. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future.

Its not a good idea to use a HELOC to fund a vacation buy a car pay off credit card debt pay for college or invest in real estate. Enter the length of your repayment period not your draw period. The amount you drive the purpose of the vehicle and how much you can afford to spend.

With a 20 down payment on a 30-year mortgage and a 4 interest rate you need a household income of 70000 yearly or more before tax. Borrow up to 350k. HELOCs have two parts.

However fixed-rate HELOCs typically have higher starting interest rates than traditional HELOCs Sterling says. Estimate your monthly loan repayments on a 500000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. First is the draw period during which you borrow money and make payments against the interest.

HELOC Payments How are HELOC repayments structured. How much income you need depends on your down payment loan terms taxes and insurance. If your credit score is on the lower end 580 or lower some lenders may offer higher interest rates or longer loan.

Be sure to label the additional payment apply to principal Simply rounding up each payment can go a long way in paying off your mortgage. A fixed-interest HELOCs payment cannot fluctuate. For example instead of 763 pay 800.

Enter your information into the early loan payoff calculator below including your additional monthly payment and click Calculate to see your total savings. With each subsequent payment you pay more toward your balance. Free calculators for your every need.

While some challenges may come with securing a home equity line of credit HELOC the benefits are often worth investing time and resources. Home equity line of credit HELOC calculator. For the loan amount.

Free Refi for Life. A HELOC is a line of credit you can draw funds from as needed similar to a credit card. A home equity loan is often referred to as a second mortgage and is taken out in one lump sum.

Click view the report to see a. Likewise investors can take advantage of otherwise stagnant equity. A lower monthly payment so you can use that extra cash to get to a better place.

For a HELOC the interest rate is typically a lenders prime rate 05. Using a HELOC on investment property will allow investors to tap into assets that have managed to build up equity. All home equity calculators.

Heres how to calculate your HELOC payment. Line of credit calculator. So if a lender increases its prime rate then your HELOC interest payment increases.

Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest. Input your data into our calculator to compare your estimated payments for a home equity loan vs. Access as much of your equity as possibleup to 350k with Lower.

For the loan term. Home equity loan and HELOC guide. When you take out a mortgage you agree to pay the principal and interest over the life of the loan.

The Bank of Canada has made it clear that they will continue raising rates this year until inflation moderates. Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. If you are considering getting a HELOC be aware that HELOC rates will continue to rise in the likely event of further rate hikes.

Get a Lower HELOC then pay no lending fees on future refinances for life. Home equity line of credit HELOC calculator. Dont enter your total credit limit unless you plan on using the full amount.

This free online calculator will calculate the monthly interest-only HELOC payment given your current balance plus calculate the principal and interest payment that will take effect once the draw period expires. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home. They should calculate what their new mortgage payment is and budget for more increases to come this year.

The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount that can be converted is limited to 90 of the maximum line amount. Its OK to estimate if you arent sure. Home equity loan and HELOC guide.

If you would like to calculate the size of the home equity line of credit you might qualify for please visit the HELOC Calculator. The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment. Line of credit calculator.

There are also market factors. Account for interest rates and break down payments in an easy to use amortization schedule. For example a 30-year fixed mortgage will have a lower monthly payment than a 15-year fixed but will require you to pay more interest over the life of the loan.

The minimum loan term is 1 year and the maximum term will not exceed the account maturity date. Then comes the repayment period when as the name. A common strategy is to divide your monthly payment by 12 and make a separate principal-only payment at the end of every month.

The draw period is the phase. If you fail to make payments on a HELOC you could lose.

Home Equity Line Of Credit Qualification Calculator

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator Calculate Available Home Equity Wowa Ca

Home Equity Calculator Free Home Equity Loan Calculator For Excel

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Heloc Calculator

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Heloc Calculator How To Get To Your Payoff Date Youtube

Looking For A Heloc Calculator

Mortgage Payoff Calculator With Line Of Credit

Home Equity Calculator Free Home Equity Loan Calculator For Excel

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Home Equity Line Of Credit Heloc Rocket Mortgage

How A Heloc Works Tap Your Home Equity For Cash